0

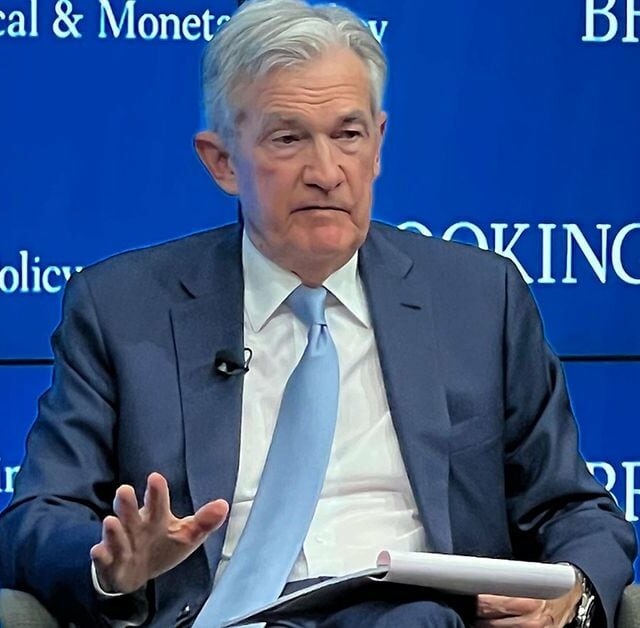

benchmark federal funds rate, Bitcoin, cryptocurrency market., economic projections., Federal Reserve, inflation, Jerome Powell, monetary policy, rate cut, stock market, unemployment

The Federal Reserve's recent rate cut has far-reaching implications for financial markets, investments, consumer behavior, and the overall economy. Lowering interest rates typically aims to stimulate economic growth by making borrowing cheaper. This can lead to increased consumer spending and business investments, which are crucial for economic expansion.

In financial markets, a rate cut often results in lower yields on bonds, making equities more attractive. Investors may shift their portfolios towards stocks, driving prices up. Additionally, real estate markets may see increased activity as mortgage rates decrease, encouraging home purchases and refinancing.

From a consumer perspective, lower interest rates can lead to more accessible credit, promoting higher consumer spending on big-ticket items such as cars and homes. This increased spending can boost economic growth and consumer confidence, creating a positive feedback loop.

However, the implications are not entirely positive. Prolonged low rates can lead to asset bubbles, as investors search for higher returns in riskier assets. Moreover, savers may struggle to earn adequate returns on their savings, which could impact their financial security in the long term.

Looking ahead, future projections suggest that the Federal Reserve will continue to monitor economic indicators closely. If inflation remains subdued and economic growth is sluggish, further rate cuts may be on the horizon. Conversely, if the economy shows signs of overheating, the Fed may need to raise rates to prevent inflation from spiraling out of control.

In conclusion, the recent rate cut by the Federal Reserve is a strategic move to foster economic growth. Its impacts on financial markets, consumer behavior, and the economy are significant and complex, requiring careful monitoring and analysis as conditions evolve. / READ MORE /