0

Bitcoin, crypto futures, Cryptocurrency, geopolitical tensions, Gold, investment., Iran, Israel, long positions liquidation., market overview, price fluctuations

Bitcoin, the leading cryptocurrency, has shown signs of rebounding amidst rising geopolitical tensions that have affected global markets. As traditional markets react to uncertainty, Bitcoin's performance and stability are being compared to gold, a long-standing safe-haven asset. This analysis explores how market reactions and investor sentiment are shaping the future of digital assets during these uncertain times.

In recent months, geopolitical events such as conflicts, trade disputes, and economic sanctions have led to increased volatility in traditional financial markets. Investors often seek refuge in gold, which has historically been viewed as a stable store of value during turbulent times. However, Bitcoin has also begun to emerge as an alternative investment amid these crises, sparking a debate about its role in a diversified portfolio.

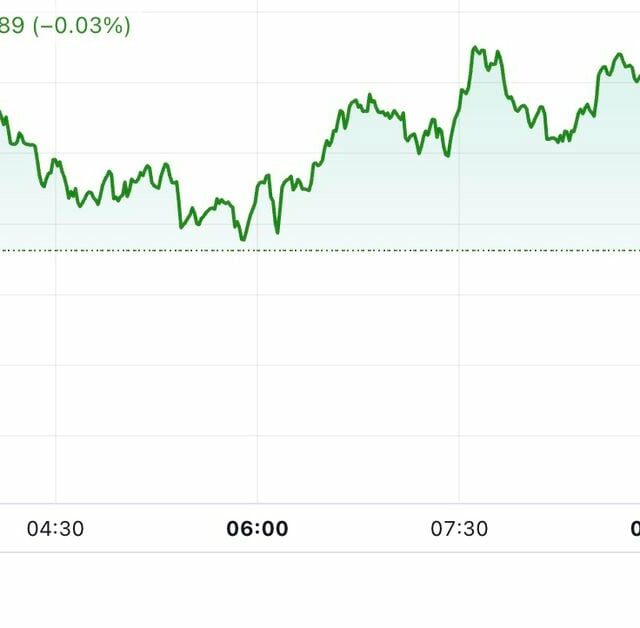

Market reactions to geopolitical tensions have varied, with Bitcoin often responding differently than gold. While gold typically appreciates in value during times of crisis, Bitcoin’s price movements can be more erratic. This unpredictability has led some investors to remain cautious about Bitcoin, while others see its potential for high returns.

Investor sentiment plays a crucial role in the performance of both assets. The rise of institutional interest in Bitcoin has contributed to its rebound, as large investors and hedge funds increasingly view it as a legitimate asset class. This shift in perception is fostering a more robust market for cryptocurrencies, even as traditional investors may continue to favor gold for its historical stability.

Looking ahead, the future of digital assets like Bitcoin in uncertain times remains to be seen. Factors such as regulatory developments, technological advancements, and the evolving landscape of global finance will influence how cryptocurrencies perform relative to traditional assets like gold. As the world grapples with geopolitical challenges, the dynamics between Bitcoin and gold will likely continue to evolve, shaping the investment strategies of individuals and institutions alike. / READ MORE /